Trial Balance

The trial balance is the bridge between the final accounts and ledger accounts. It is prepared by the accountant as on the closing date of the accounting year. When there is a trial balance prepared as on the last date of the accounting year and the balances of all the ledger accounts are found in a single list, which will facilitate the quick and easy preparation of final accounts.

Hence, later all the transactions of the accounting year are entered either in a single journal or in various subsidiary books and posted there from to appropriate accounts in the ledger, it's desirable to verify whether all the entries in the books of accounts are arithmetically accurate. For this purpose, a list of credit and debit balances of all the ledger accounts known as trial balance and it is prepared as on the last date of the accounting year.

Trial Balance Definition

The trial balance is defined as an abstract or list of the balances or of total credits and total debits of the accounts in a ledger, the purpose being to determine the equality of posted credits and debits and to establish a basic summary for the financial statements.

Trial Balance Advantages

1. Errors in the accounts books are detected by a trial balance and are rectified before preparing the final accounts. That means, trial balance ensures that the final accounts reveal the true outcomes.

2. The ledger accounts balances found in the trial balance serve as a rough guide as to the state of affairs of the firm.

3. An agreement of the trial balance is a prima fascia evidence of the proper application o f the double entry system principle.

4. Trial balance contains the closing balances of all the ledger accounts arranged in the order of credit and d debit and the trial balance facilitates quick and easy final accounts preparation.

Disadvantage of Trial Balance

1. The trial balance is that it is not a part of books of another maintained under the double entry system of book keeping.

2. Trial balance can be prepared only in those concerns where double entry system of accounting taken.

3. The trial balance is that a tallied trial balance is not a conclusive proof of the accuracy of the books of account. Because certain kinds of errors, such as principle errors, errors of compensating, complete omission errors etc. Remain even when trial balance matches.

Trail Balance Example

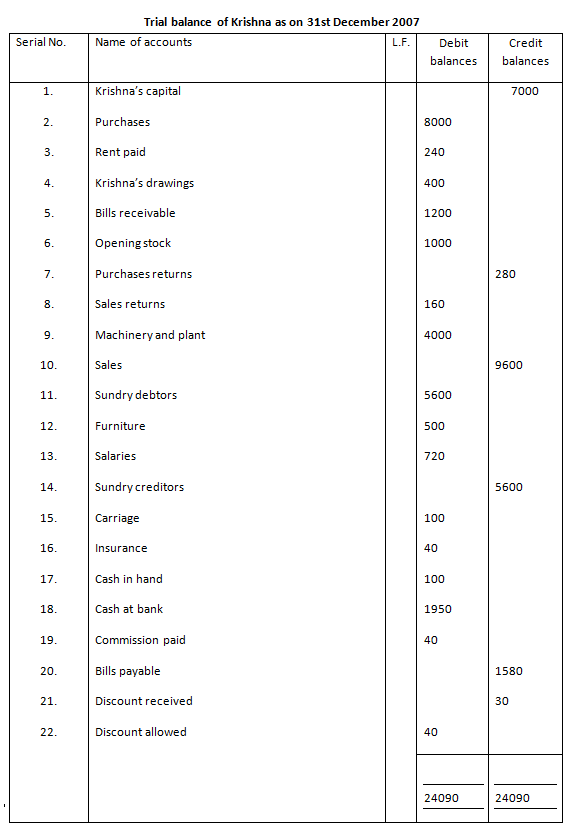

1. From the following balances extracted from the books of Krishna as on 31st December 2007. Prepare a trial balance.

Solution:

Average Acceleration Calculator

Average acceleration is the object's change in speed for a specific given time period. ...

When an object falls into the ground due to planet's own gravitational force is known a...

In Mathematics, the permutation can be explained as the arrangement of objects in a particular order. It is an ordered...

A rectangle can be explained as a 4-sided quadrilateral which contains equal opposite sides. In a rectangle

A three sided polygon which has three vertices and three angles is called a triangle. Equilateral triangle...