Cash Book

A cash book is just like a cash account statement. In these the difference is that it enters transactions linked to both bank and cash. A cash book follows

the principles of actual account. That is credit-decrease in value of dealing, debit-increase in value of asset. These shows that if there is increase in

the balance of bank and cash due to any receipts they each should be debited in cash book (account). Once when there's decrease in balance of bank and cash

due to any payment the transaction (dealings) should be credited in the book (account).

The cash books are simple accounting books that are used to enter basic data about cash payments and receipts. Sometime available in hard copy formal, the cash books are much included in different kinds of money management software system. Offering an simple way of maintaining with how much money is getting in and what bills are receiving paid, cashbook can be effectively used by just about anybody.

Types of Cash book

A journal in which all cash payments and receipts (letting in bank withdrawals and deposits) are recorded 1st in chronological manner for posting to general ledger book. The cash book is regularly made up with the bank instructions as an internal auditing amount. And in larger company, it's generally divided into 2 divisions:

(1) The cash expense journal in which all payments of cash (specified as accounts owed, operating cost, petty cash buys) are entered.

(2) The cash receipts journal (day book) in which all receipts of cash (specified as accounts due, sale of assets, cash sales) are entered.

Financial journal that contains all cash payments and receipts, letting in bank withdrawals and deposits. Accounting entries in the cash book are then placed into the general ledger (account). Cash book is periodically made up with the bank instructions as an internal method of inspecting.

The larger firms generally divide the cash book into 2 parts. First part is the cash outlay journal that records all cash payments, much as accounts collectable and budget items. Second part is the cash gross journal which records all cash gross, much as cash sales and accounts receivable.

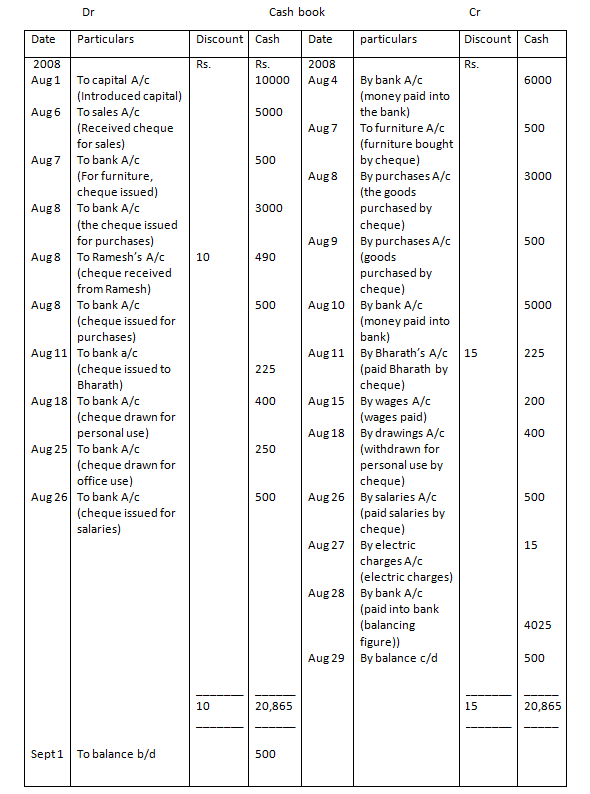

Cash Book Example

1. Record the following transactions in a two-column cash book (cash and discount column).

2008

Aug 1 Started business concern with Rs. 10000 in cash.

Aug 4 Opened a current account with "bank of India" and deposited therein Rs.6000.

Aug 6 Cheque received for Rs. 5000 and sold goods.

Aug 7 Cheque issued for Rs. 500 for purchased furniture.

Aug 8 Goods purchased for Rs. 3000 and paid by cheque.

Aug 8 Cheque received for Rs. 490 in settlement of Rs. 500 an account from Ramesh.

Aug 9 Goods purchased for Rs. 500 and gave a cheque for the same.

Aug 10 Money paid into "Bank of India" Rs. 5000.

Aug 11 Paid Bharath Rs. 225 in settlement of his account for Rs. 240 by cheque.

Aug 15 Wages paid in cash Rs. 200.

Aug 18 Cheque drew for personal use Rs. 400.

Aug 25 Money drew for office use Rs. 250.

Aug 26 Salaries paid by cheque Rs. 500.

Aug 27 Electric charges paid in cash Rs. 15.

Aug 28 Paid in excess of Rs. 500 to "Bank of India".

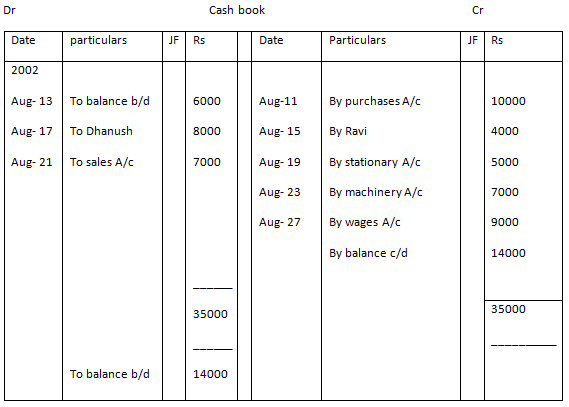

2. Write the following transactions in the simple cash book.

2002

Aug- 11 Purchased goods for cash Rs. 10000

"13 Cash in hand Rs. 6000

"15 Paid to Ravi Rs. 4000

"17 Received from Dhanush Rs. 8000

"19 Paid for stationary Rs. 5000

"21 cash sales Rs. 7000

"23 Purchased office machinery Rs. 7000

"27 Wages paid Rs. 9000

Answer:

Average Acceleration Calculator

Average acceleration is the object's change in speed for a specific given time period. ...

When an object falls into the ground due to planet's own gravitational force is known a...

In Mathematics, the permutation can be explained as the arrangement of objects in a particular order. It is an ordered...

A rectangle can be explained as a 4-sided quadrilateral which contains equal opposite sides. In a rectangle

A three sided polygon which has three vertices and three angles is called a triangle. Equilateral triangle...