Admission of a Partner

As per the 'Indian partner Act 1932', a person may be admitted as partner in the firm either with consent of all existing partner or in an accordance with the contract already made between the existing partners in the firm for the admission of new partners in the business concern.

At the time of admission of partner, some of the point s to remember is as follows:

1. Calculate the new profit sharing ration and sacrificing ratio.

2. Reevaluate the liabilities and assets.

3. Accumulation of profit or losses, resources distribution.

4. Calculation of goodwill.

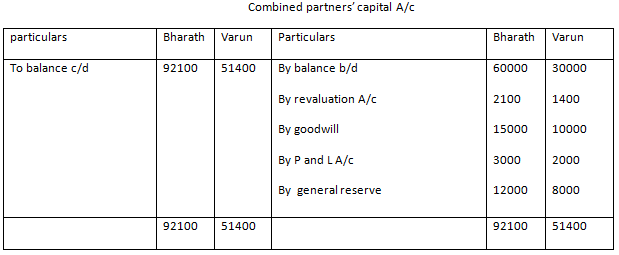

5. Partners' capital A/c adjustments.

Difference between new profit sharing ratio and sacrificing ratio

The new profit sharing ratio is the ratio in which the partners of the re-constituted or new firm will share the profit or loss of the firm in future years.

In other words, the new profit sharing ratio is the ratio in which all the partners in the business concern including new partners share the profit or loss of the firm.

For calculating the new profit sharing ratio, use the formula mentioned below:

New Profit Sharing Formula

New profit sharing of each old partner = Remaining share of the firm x Agreed ratio

The sacrificing ratio or sacrifice ratio refers to the ratio in which old partner's sacrifices or surrenders a part of their share of profit of the partner in the firm on his admission day.

To calculate the sacrificing ratio, apply the formula mentioned below:

Sacrificing Ration Formula

Sacrifice ratio = old ratio - new ratio

Goodwill

The goodwill is the value of established business concern over and above the value represented by tangible property of the firm. It is reputation or goodwill or good name or super profit earning capacity of the firm.

In other words, the goodwill is an asset, intangible asset which cannot touch and seen.

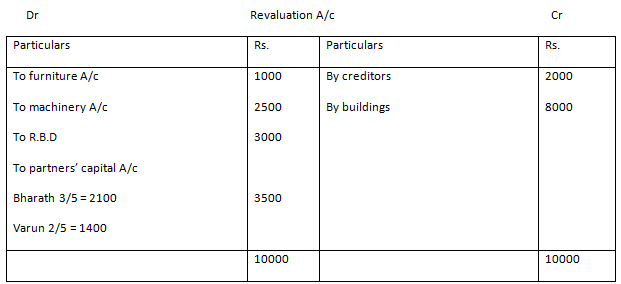

Revaluation Account

The revaluation account is an account which prepared to revaluation of liabilities and assets of the firm in order to find out net profit or net loss on revaluation of the liabilities and assets of the firm.

Admission of partnership account example:

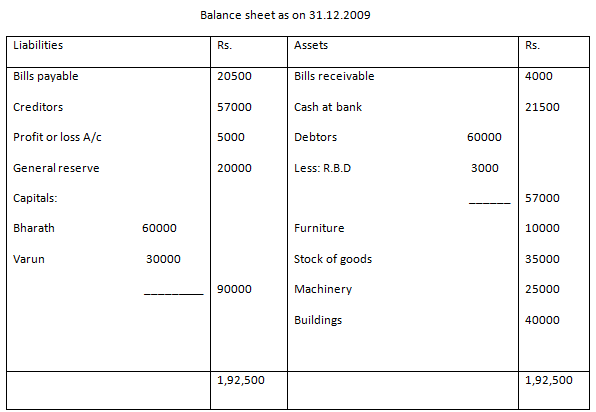

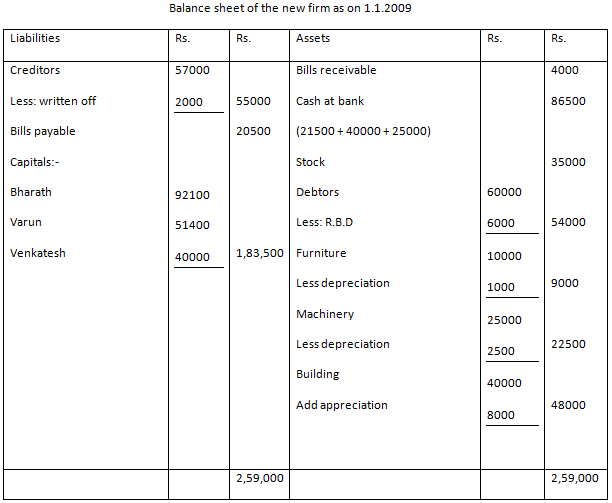

1. Bharath and Varun are partners sharing profit and losses in the ratio of 3:2. Their Balance sheet as on 31.12.2009 was as follows:-

On 1.1.2010 Venkatesh is admitted into partnership on the following terms as below:

a. Venkatesh should bring Rs. 40000 as capital for 1/4 share and goodwill towards Rs. 25000.

b. Appreciate buildings by 20%.

c. Depreciate furniture and machinery by 10%.

d. An amount of Rs. 2000 due to a creditors, is not likely to be claimed and hence to be written off.

e. Increase R.B.D on debtors to Rs. 6000.

Prepare:

(i) Revaluation A/c.

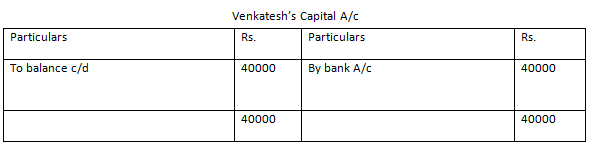

(ii) Partner's capital A/c.

(iii) Balance sheet.

Solution:

Average Acceleration Calculator

Average acceleration is the object's change in speed for a specific given time period. ...

When an object falls into the ground due to planet's own gravitational force is known a...

In Mathematics, the permutation can be explained as the arrangement of objects in a particular order. It is an ordered...

A rectangle can be explained as a 4-sided quadrilateral which contains equal opposite sides. In a rectangle

A three sided polygon which has three vertices and three angles is called a triangle. Equilateral triangle...